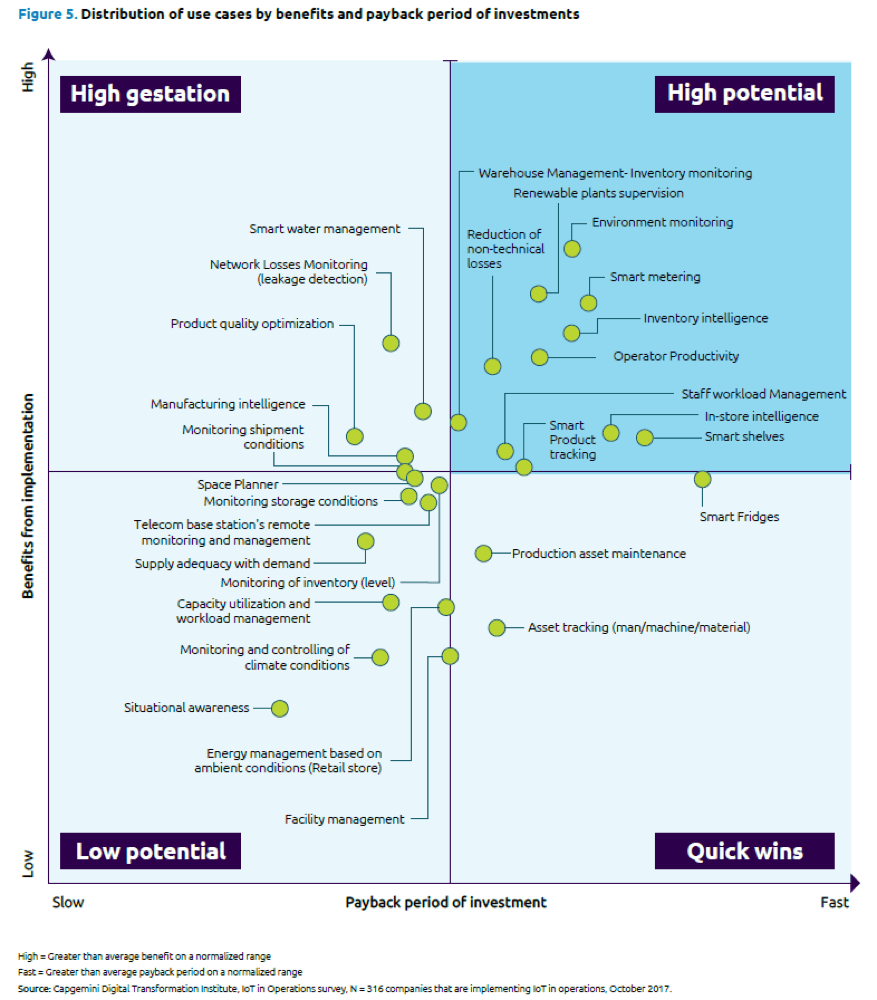

Bottom Line: IoT lessons learned on the shop floor transfer to new product development and are fueling the next generation of smart, connected products. Capgemini predicts by 2020 47% of all products will be IoT-enabled, capable of supporting new product-as-a-service business models.

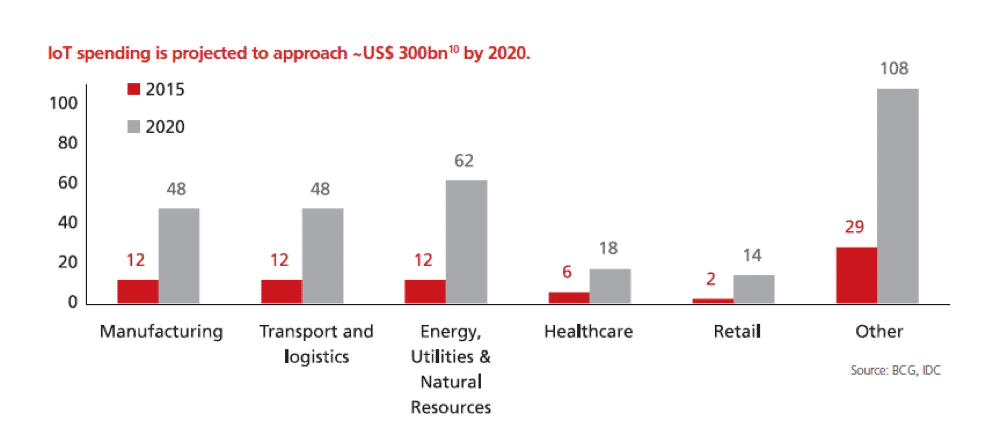

- According to IDC, the IoT marketplace will attain a compound annual growth rate (CAGR) of 14.4% through the 2017-2021 forecast period surpassing $1T in 2020 and reaching $1.1T in 2021.

- North American manufacturers are investing $45B in IoT apps, platforms and systems this year, projected to increase to $75B in 2022, attaining a 13.6% Compound Annual Growth Rate (CAGR) according to Statista.

- Verizon’s latest study of IoT adoption finds that manufacturing dominates the global growth of IoT network connections in the last year, growing 84% over 2016.

- By 2020, 50% of IoT spending will be driven by discrete manufacturing, transportation, and logistics, and utilities according Boston Consulting Group.

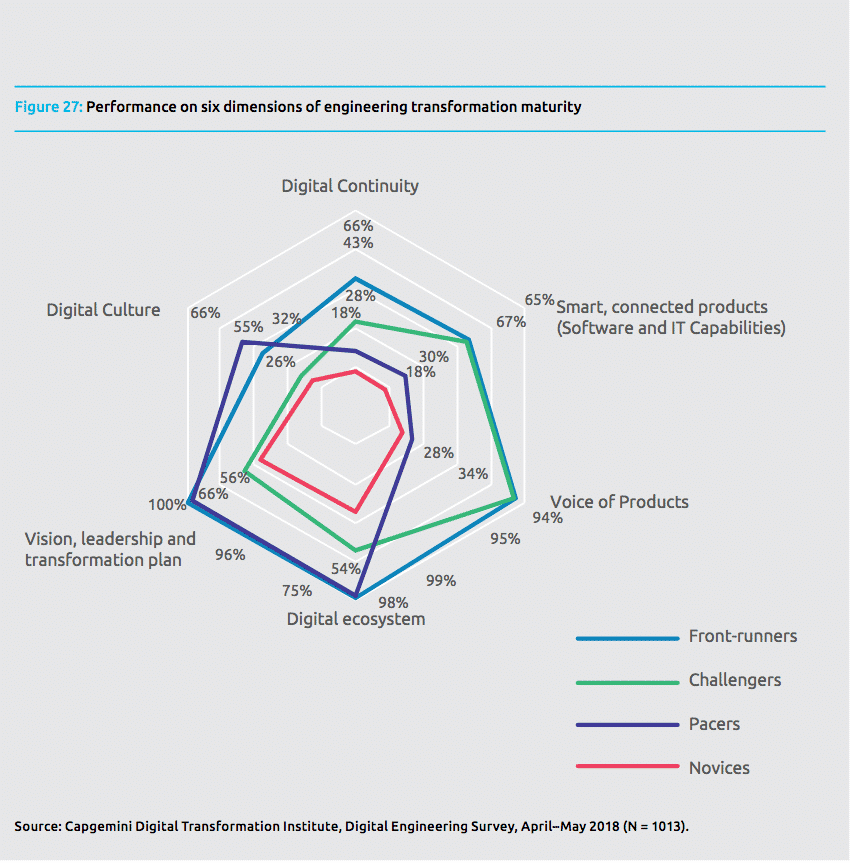

IoT is proving to be a pivotal in digitally transforming manufacturers and enabling entirely new product lines and business models. Capgemini recently interviewed over 1,000 senior executives of large, discrete manufacturing organizations around the world. The manufacturing execs predict that 47% of all their products will be smart, connected and capable of generating product-as-a-service revenue by 2020. 66% say the many challenges of sustaining legacy products while pursuing new product-as-a-service digital business models makes IoT the platform of choice.