In March of this year, the EU Sustainable Finance Disclosure Regulation (SFDR) [3] came into effect. This regulation “lays down harmonised rules for financial market participants and financial advisers on transparency with regard to the integration of sustainability risks and the consideration of adverse sustainability impacts in their processes and the provision of sustainability‐related information with respect to financial products.”

What this means is that investors putting capital into Europe, or marketing investments in Europe, will be subject to binding Environment Social Governance (ESG) disclosure obligations. The regulation precedes the new EU Taxonomy [4] for sustainable activities, which will provide a clear definition of sustainability and require investments promoted as environmentally friendly to be clear on their green objectives.

The EU Taxonomy will come into effect in 2022 and is designed to direct more investment towards green projects. Similar regulations are being considered in the US and UK, as the EU directives will apply to companies in these regions operating in the EU area.

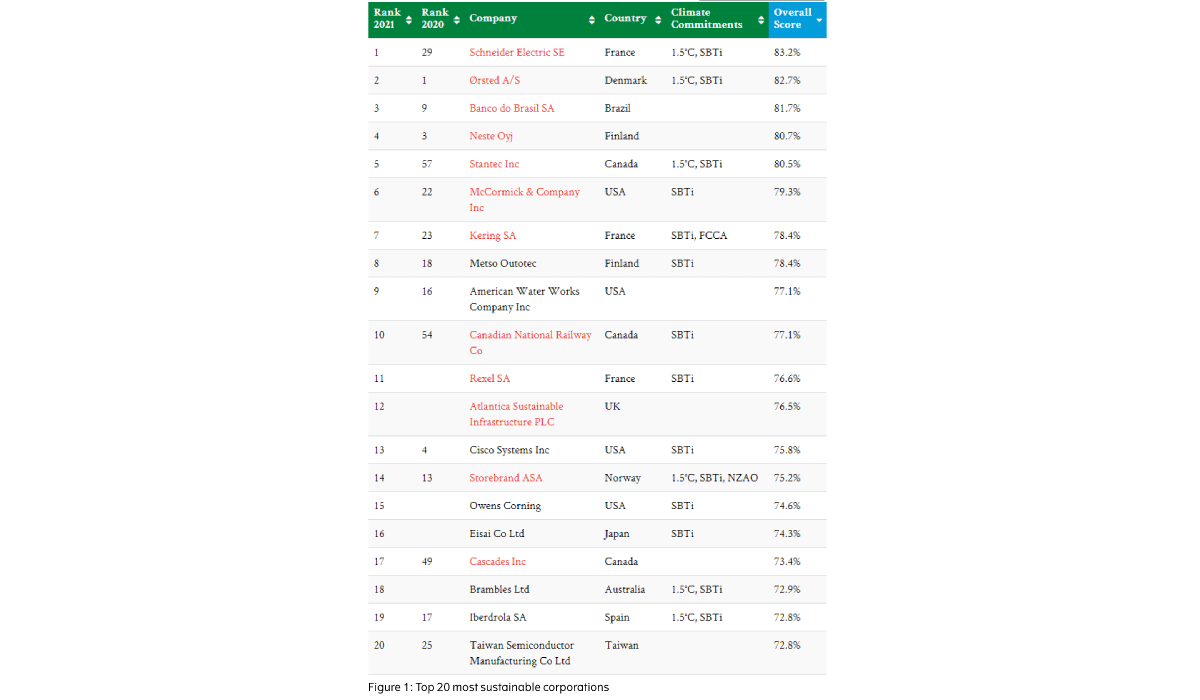

While these regulations primarily target the financial industry, the impact will be felt in every other sector as regulations like these redirect funds towards more sustainable projects and companies.